Costco Raises Gold Prices, 1970s Playbook Update, FedWatch, Gold and Silver Charts

Weekly Recap for the Week Ending March 22, 2024

1. Costco raises prices on gold bullion

Costco gold bullion coins and bars have held at $2,219.99 per ounce for a couple of weeks. But after the Fed announced that three rate cuts are coming in 2024 the price of gold surged followed by a bump in Costco gold to $2,249.99 per ounce.

Gold has since pulled back to around $2,179 per ounce. We’ll have to wait and see if Costco holds higher or adjusts back to current prices.

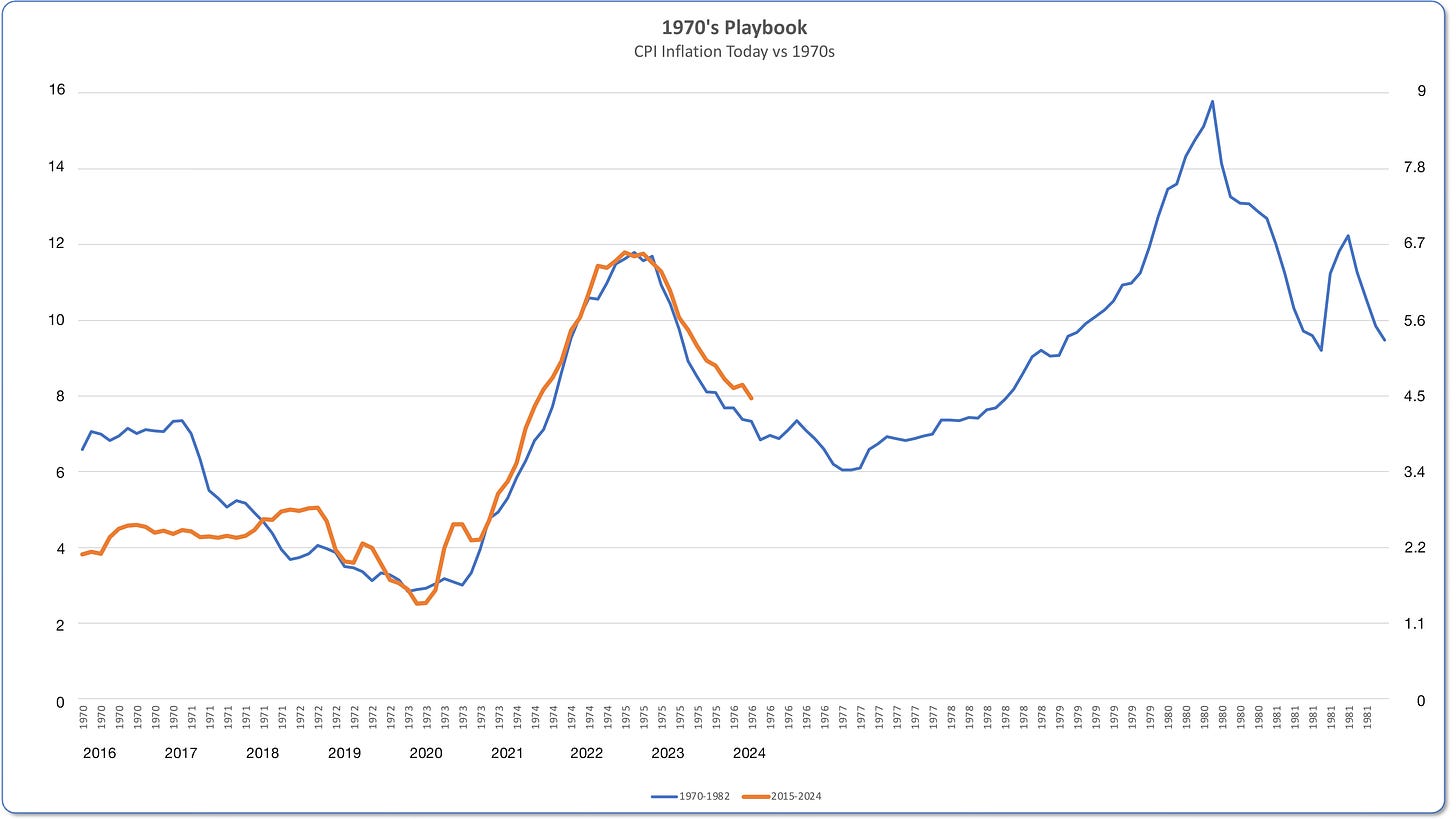

2. The 1970s playbook gets an update

Last month we covered the 1970s Playbook and how today’s inflation mirrors the Great Inflation of the 1970s. This chart has been updated with the latest data from the FRED.

The blue line is 1970s CPI inflation taken from the Fed’s data – Sticky Price Consumer Price Index less Food and Energy.

The red line is today’s inflation starting at the end of 2015 overlaying the 1970s data. The data has not been compressed horizontally or vertically to make these fit. The blue line is indexed to the axis on the left while the red line is indexed to the axis on the right. That’s all there is to it.

But wait, doesn’t the Fed have a target inflation rate of 2% while your chart shows 3.4% as the terminal rate? True, but consider this ZeroHedge article going over a recent Goldman note:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

The bank’s conclusion:

For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle.

What the 1970s playbook chart shows is moderately lower inflation ahead as the Fed lowers interest rates three times this year, likely for a total of 75 basis points. That’s exactly what Powell said this week, that there will be three rate cuts in 2024. That will be followed by sideways inflation for 1 to 2 years, and then it’s off to the moon.

I’ll keep this chart updated every month so be sure you’re subscribed to The Pipeline.

Check out my 40 Emergency 'Go Bag' Essentials From Amazon

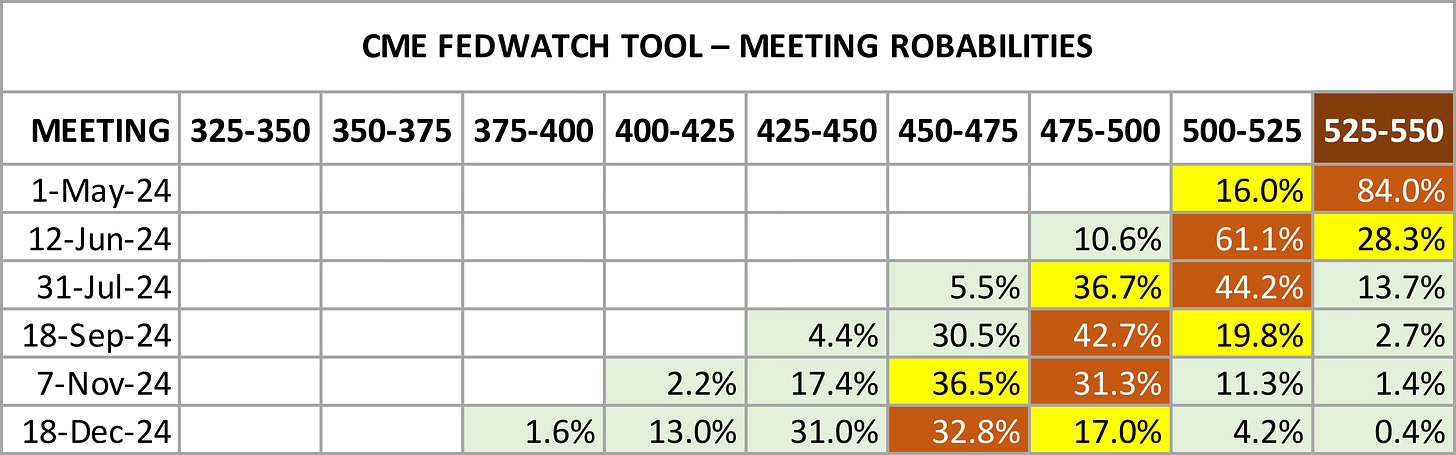

3. CME FedWatch chart

After Fed Chair Powell’s statement that there would be three rate cuts this year the CME FedWatch tool gyrated for a day or two. We seem to have a stable pattern now with red squares remaining to the right, indicating lower probabilities of additional rate cuts beyond Powell’s three cuts in 2024.

The most likely scenario is one rate cut in June or July and then two more in September/December for three cuts totaling 75 basis points.

4. Gold and silver charts

Gold

Fueled by FOMO, gold buyers eagerly snatched up available inventory despite limited gold coin sales events. During the week volume spiked in discount-priced coins while remaining steady on regular-priced products.

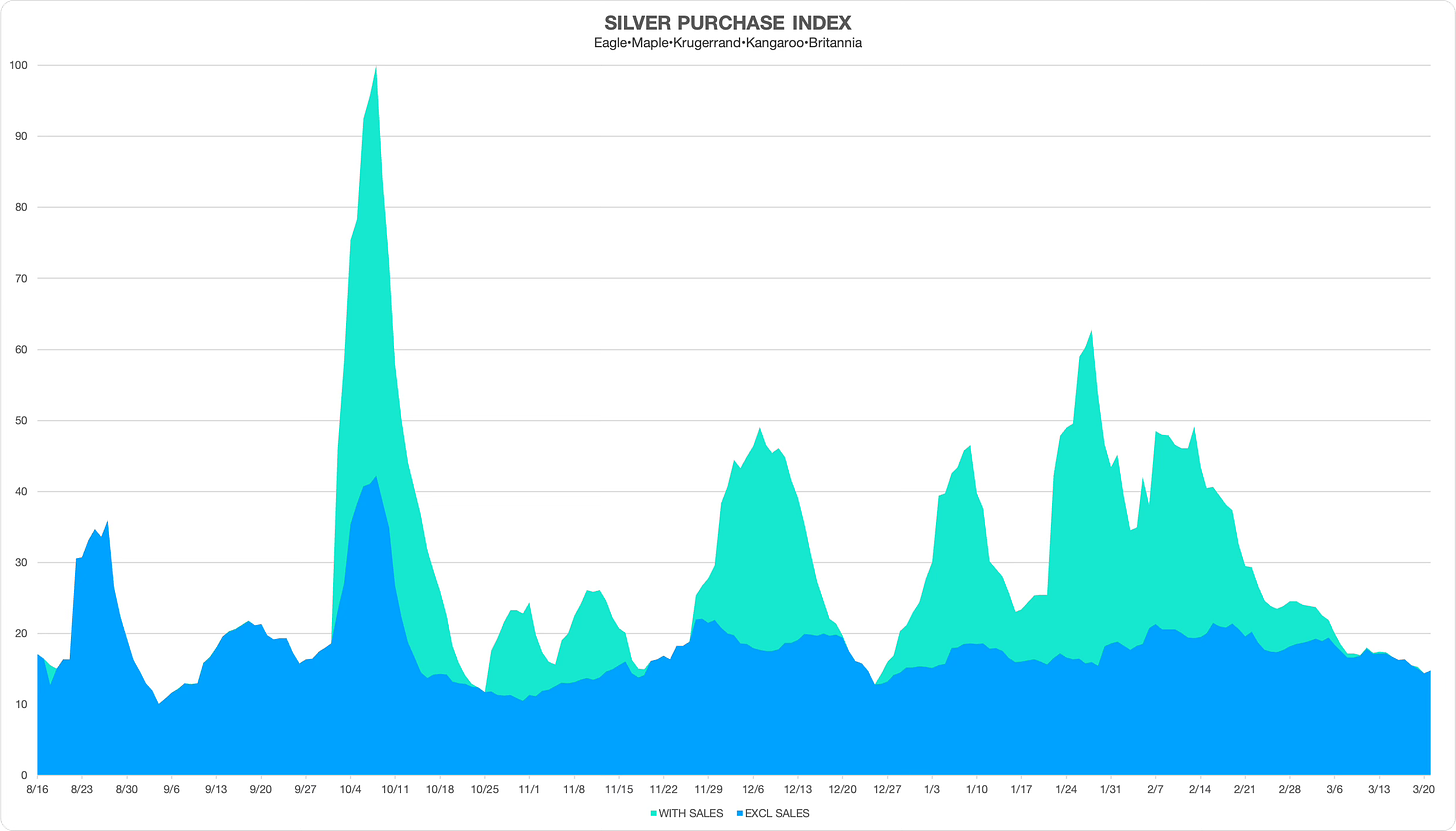

Silver

We’ve seen some pullback in online dealer discounts in silver premiums, indicated by the green-shaded area. The blue shade shows the volume of regular-priced bullion coins, which have remained rangebound since early January.

With gold’s recent surge to all-time highs, buyers were eager to jump on gold deals, as indicated by the green peak to the right side of the chart. Silver bullion action remained muted.

Disclaimer: City Stacker is intended to provide general information and personal opinions related to disaster preparedness and investing in precious metals. I am not a certified financial planner (CFP), chartered financial analyst (CFA), or a certified public accountant (CPA). The content of this publication should never be considered a substitute for professional financial advice. Before taking any action based on anything within this publication, you should always consult with a qualified financial professional familiar with your unique situation. Investing involves risks, and I am not liable for any investment decisions made or results obtained from the use of information in this publication.