Gold Hits All-Time High, Layoffs Ease, FedWatch, Gold and Silver Charts

Weekly Recap for the Week Ending March 8, 2024

Domestic

1. Gold hits all-time high

Following last week’s core PCE inflation-fueled buying, gold prices continued to be bid up this week on expectations of Fed rate cuts in June.

Gold bugs were eager to buy, bidding gold price up to over $2,200 intra-day on Friday. As FOMO buyers rush in, I expect to see strong gold prices continue into next week. Mainstream news reporting on gold's recent performance and its potential for further gains will likely fuel this momentum.

2. Layoffs ease

Rising costs and fears of a recession are leading companies to announce layoffs to cut expenses. So far, March is seeing a reduced velocity of layoffs compared to prior months.

Companies announcing job cuts in 2024:

March

Inscribe: 40% of workforce

Our Next Energy: 13% of workforce

Project Ronin: 100% of workforce

Pristyn Care: 7% of workforce

February

Fisker: 15% of workforce

Electronic Arts: 5% of workforce

Sony Interactive: 8% of workforce

Bumble: 30% of workforce

Expedia: 8% of workforce

Finder: 17% of workforce

Buzzfeed: 16% of workforce

Rivian: 10% of workforce

Farfetch: 25% of workforce

CISCO: 5% of workforce

Wint Wealth: 20% of workforce

Away: 25% of workforce

Instacart: 7% of workforce

Mozilla: 5% of workforce

Riskified: 6% of workforce

Wisense: 100% of workforce

Everybuddy: 100% of workforce

CodeSee: 100% of workforce

Grammarly: 230 employees

Docusign: 6% of workforce

Amazon: 400 employees

Snap: 10% of workforce

Twig: 100% of workforce

Okta: 7% of workforce

Zoom: 2% of workforce

Polygon: 19% of workforce

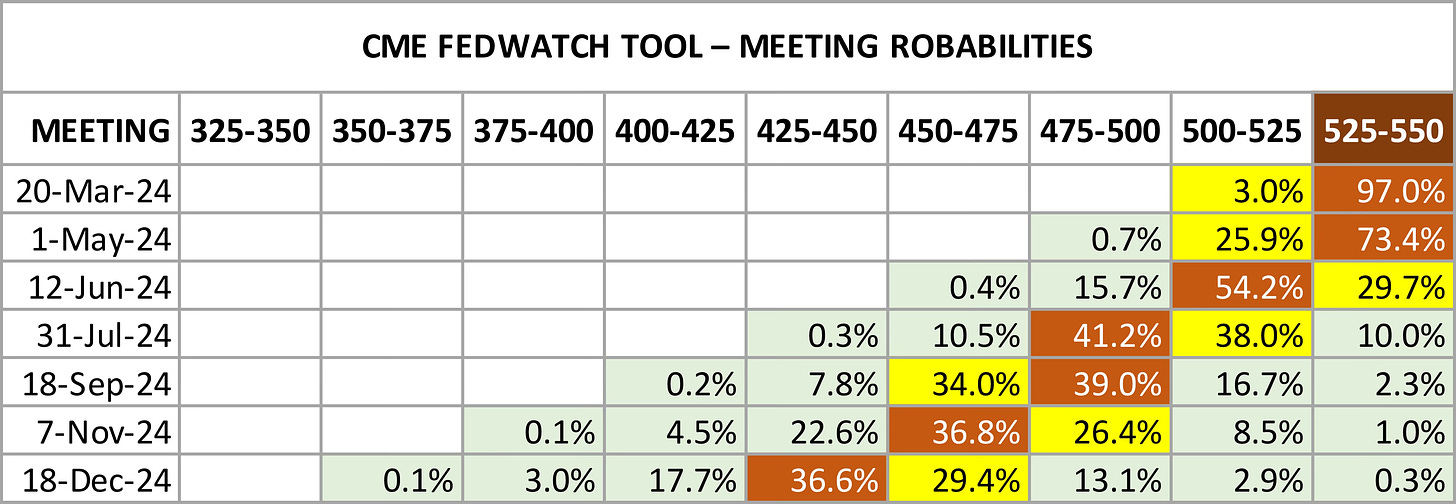

3. CME FedWatch chart

Up slightly from the prior week, the first likely cut is expected in June with a 57.4% probability of a 25 basis point reduction. Like last week, the chart suggests four cuts totaling 100 basis points are the most likely scenario for the year.

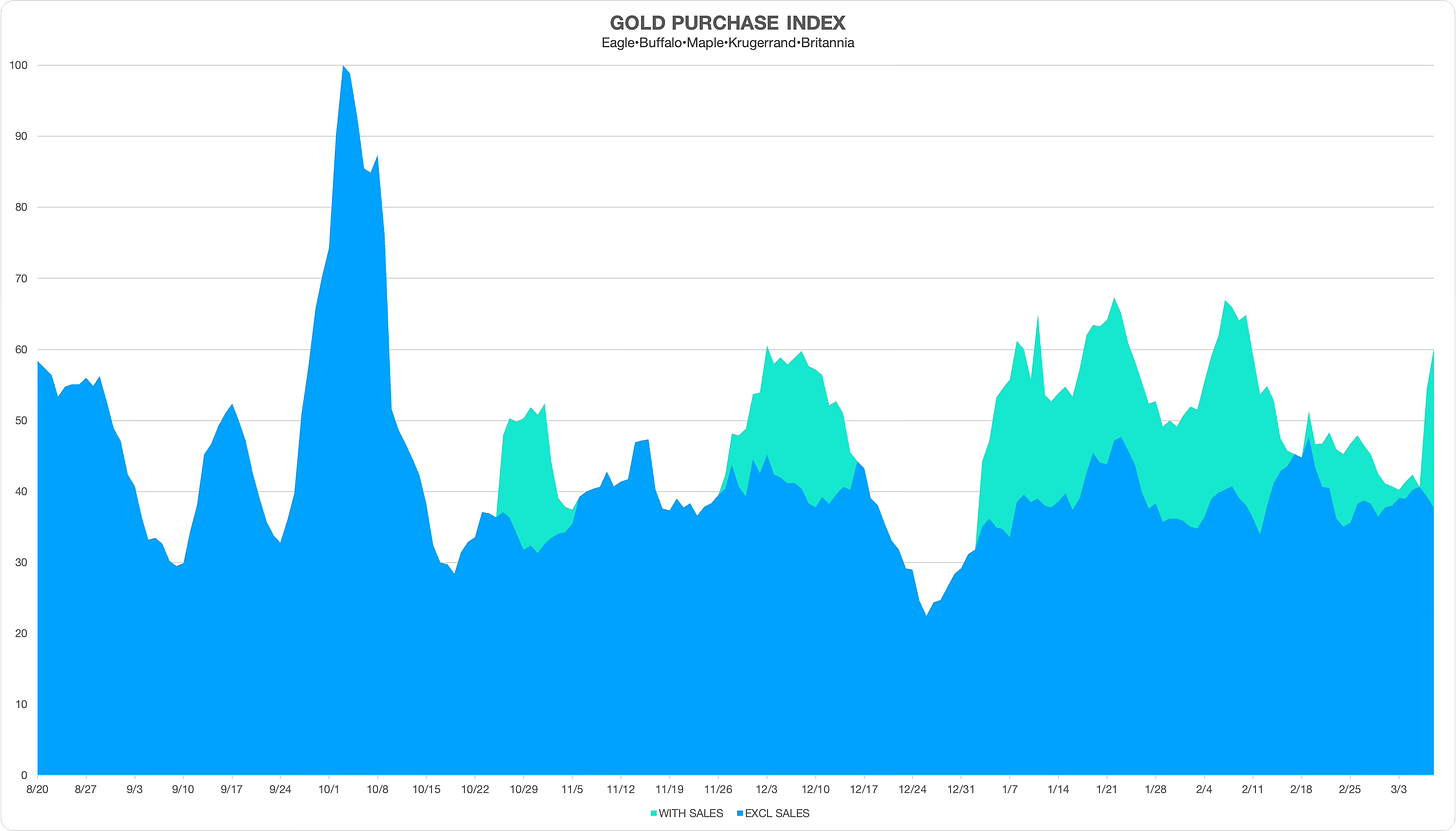

4. Gold and silver charts

Gold

Fueled by FOMO, gold buyers eagerly snatched up available inventory despite limited gold coin sales events. During the week volume spiked in discount-priced coins while remaining steady on regular-priced products.

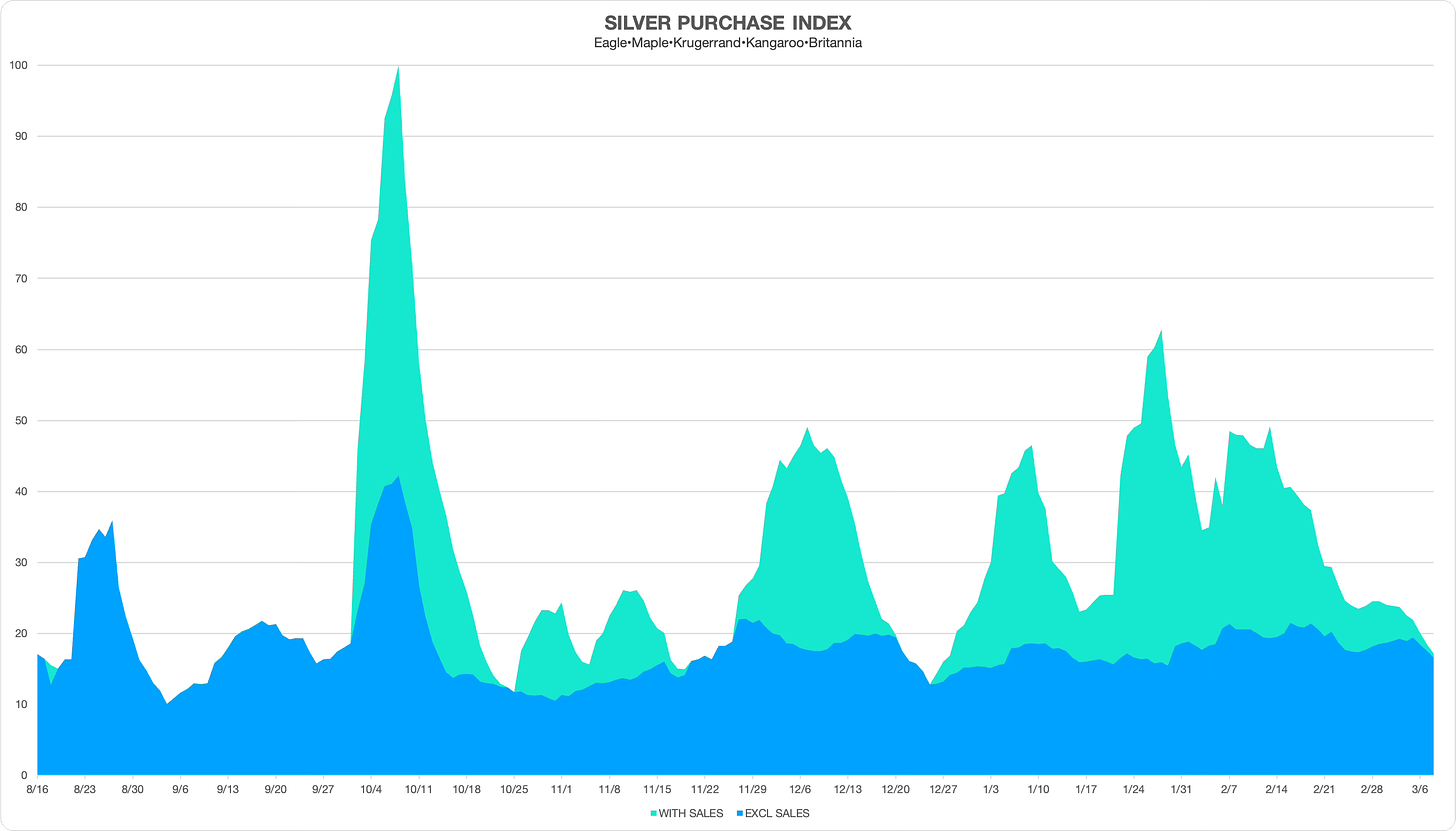

Silver

We’ve seen some pullback in online dealer discounts in silver premiums, indicated by the green-shaded area. The blue shade shows the volume of regular-priced bullion coins, which have remained rangebound since early January.

A reduction in discounted premiums volume would potentially indicate a change in the trend toward higher premiums. Watch out for that.

Disclaimer: The Pipeline is intended to provide general information and personal opinions related to disaster preparedness and investing in precious metals. I am not a certified financial planner (CFP), chartered financial analyst (CFA), or a certified public accountant (CPA). The content of this publication should never be considered a substitute for professional financial advice. Before taking any action based on anything within this publication, you should always consult with a qualified financial professional familiar with your unique situation. Investing involves risks, and I am not liable for any investment decisions made or results obtained from the use of information in this publication.