The news

Our gold and silver index charts are usually part of our Weekly Wrap section at the end of the week. However, a trend has been developing over the past two weeks which I believe is important enough to take notice of now.

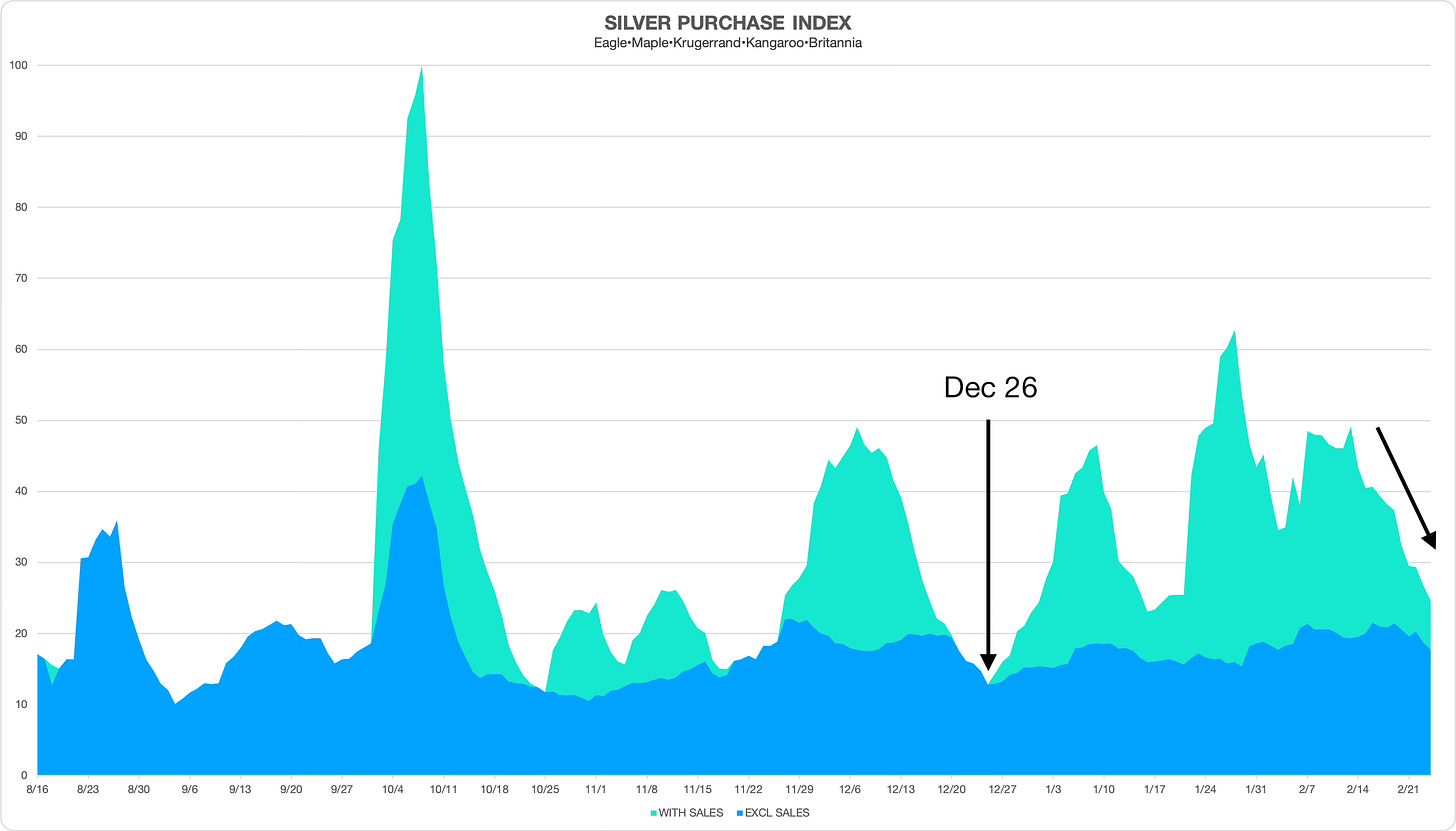

Let’s look at the Silver Purchase Index to see what’s been developing.

For those of you who haven’t seen this chart before, this comes from my research into sales at online bullion dealers. The blue-shaded area shows customer volume for regular-priced bullion coins while the green shade is for sale-priced items. I’ve said to keep an eye on those two lines and as they begin to converge it likely signals a change in the market with higher premiums ahead.

Starting December 26 of last year, strong sales were detected which have run continuously ever since. But over the last two weeks, those sales have been steadily dropping to converge at near parity. In other words, sales are drying up. I’ve been watching this carefully day-by-day waiting for the trend to reverse but that doesn’t seem to be happening.

How the online dealer business works

Three major online bullion dealers, what I call the 'Big 3', employ a newsletter-driven business model. They are APMEX, JM Bullion, and SD Bullion. They have what appear to be intentionally inflated everyday prices on common gold and silver bullion to enable frequent sales promotions. These deals are advertised through email notifications, attracting customers to their websites.

Over the past six months, we’ve watched premiums drop, especially on overpriced bullion like American Silver Eagles. In the case of JMB, from around $18 last year to $8 today. That price is still way too high. But as we’ve already discussed, that gives them room to drop the price to attract customers through email marketing.

Why this matters

As sales become less frequent, customers face a choice: pay full price at the 'Big 3' or seek the consistently low prices offered by discount online dealers like Bold Precious Metals, Bullion Exchanges, and Pinehurst Coins. Today, those discount dealers are selling the same Silver Eagles for around a $5 premium.

Smaller sales = higher premiums.

Full price is the same thing as saying higher premiums. As sales dry up it’s a signal that premiums are on the way up.

That could be due to inventory getting tight on the supply side or customer buying volume increasing significantly on the demand side.

A similar signal is playing out in the gold bullion market

Take away

Savvy stackers understand that macroeconomic factors, such as Fed interest rate cuts, often have a significant impact on gold and silver prices. With potential cuts on the horizon along with higher spot prices and premiums, now may be a strategic time to consider adding to the stack.

Disclaimer: I am not a financial advisor, a CPA, or an attorney qualified to give financial advice. Nothing I say is meant as professional or financial advice. I'm just a guy on the internet, talking about precious metals. This is for entertainment only. If you're looking for financial, tax, legal, or other advice, please seek out a professional. It's worth acknowledging that I make mistakes frequently, so please take that into consideration.