On November 27, 2023, with gold at $1,993 and silver at $24.86, I boldly predicted on my YouTube channel that both precious metals would surge by the end of 2024. My targets were $2,400 for gold and $30 for silver.

Here's my rationale:

I anticipated the Fed easing interest rates around mid-2024. This tends to weaken the dollar, causing gold prices to rise. Historically, the gold-to-silver ratio has stabilized around 80:1. My projections assume this ratio will hold, meaning a $2,400 gold price implies a $30 silver price.

On the verge of breaking out:

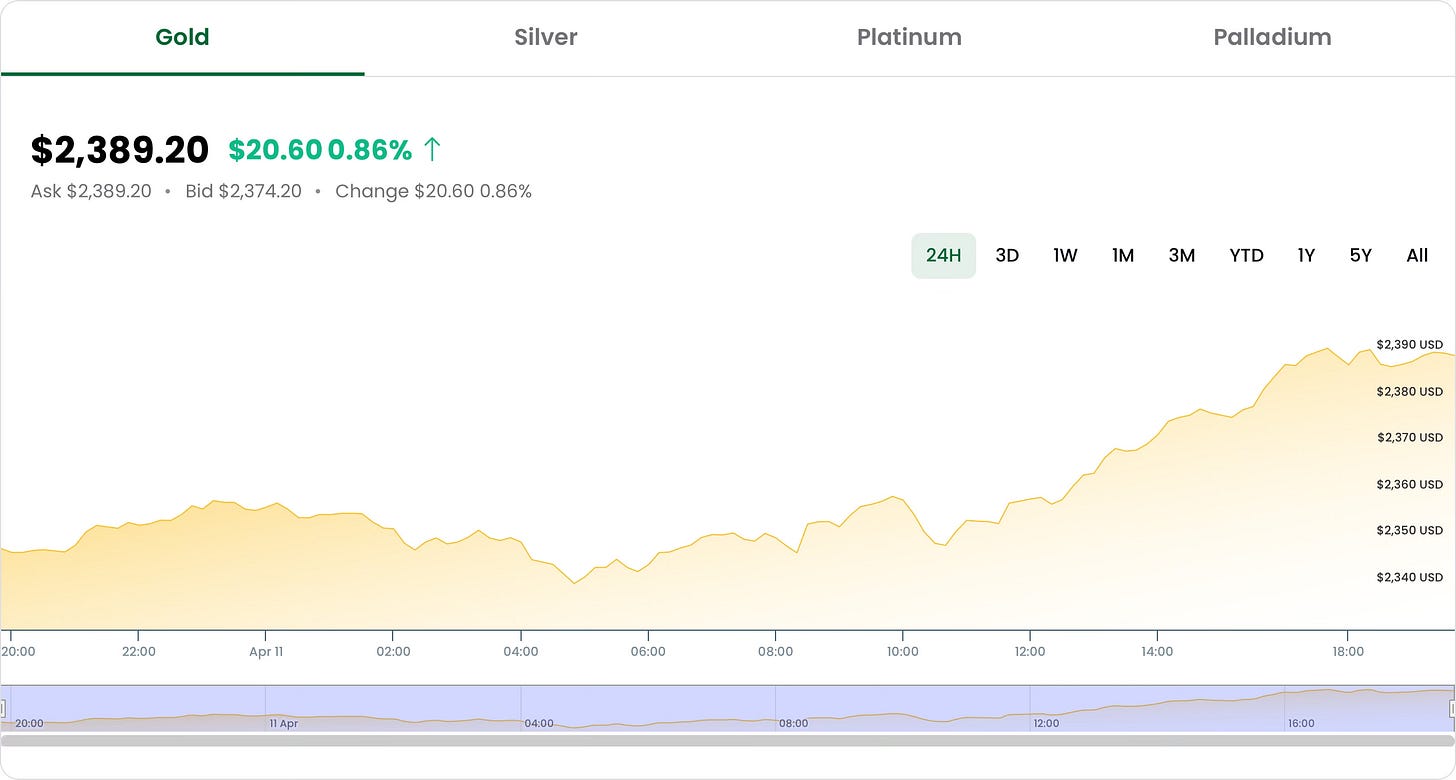

Today, April 11, gold touched $2,390. That’s just $10 shy of my end-of-year price prediction. That’s great, right? Actually, for me, it’s not. It’s troubling. I may have got the price right but it’s for the wrong reasons.

The Fed's grip slips:

This week's economic data reveals stubborn inflation, raising fears the Federal Reserve may delay or even forgo those anticipated summer rate cuts. This should spell trouble for precious metals, which usually weaken when rates rise. Yet, gold is defying expectations and soaring towards record highs.

Could it be the Fed's grip is weakening? For over a year, their interest rate decisions dictated the price of gold. But now, powerful new forces are in play – forces that might ultimately outmuscle the Fed's influence.

1. Central Bank Gold Buying:

Impact: Increased demand from central banks can drive up gold prices. If central banks are diversifying their reserves away from the US dollar and towards gold, it can weaken the dollar's influence and strengthen gold's appeal as a safe haven asset.

Evidence: Several central banks, particularly in emerging markets such as China, have been increasing their gold holdings in recent years.

2. Risks of Out-of-Control Inflation:

Impact: Gold is often seen as a hedge against inflation. If investors fear the Fed is losing control of inflation, they might flock to gold as a store of value. Rising inflation can erode the value of paper currencies like the dollar, making gold more attractive.

Evidence: Recent inflation data is concerning, and the Fed's ability to contain it without harming economic growth is a major question mark. This uncertainty is likely driving some investors towards gold.

3. Conflict in Europe and the Middle East:

Impact: Geopolitical instability can lead to increased demand for safe-haven assets like gold. Investors might seek to protect their wealth during periods of heightened risk. War creates uncertainty and disrupts traditional markets, making gold a more appealing option.

Evidence: The ongoing conflict in Ukraine and tensions in the Middle East are contributing to a more volatile global environment. This could be pushing investors towards gold as a hedge against potential economic disruptions.

The interconnected web:

It's important to remember that these factors are interconnected. Inflation fears might be driving central bank gold buying, while geopolitical tensions are adding fuel to the inflationary fire. All these events together can create a complex market dynamic where the Fed's traditional tools, like interest rate manipulation, might have a lessened impact.

What happens next?

I have no idea.

We’re in no-man’s land now with gold at record highs, and thus no ceiling to meet price with resistance.

Costco is taking gold mainstream with sales estimated by Wells Fargo to be as much as $200 million per month. Gold is making the news. Every day new record prices. The new movie "Civil War" (2024) is a dystopian thriller set in a fractured United States, and sure to make people even more nervous. Global thermonuclear war is a real threat.

It’s the 1970s all over again:

With my target price on the verge of getting taken out, here's another bold call: we could be on the cusp of a precious metals mania, just like the wild ride of the late 70s.

I was there, a stacking teenager in the thick of it. What began as a hobby turned surreal overnight: lines around the block to sell the family silverware! Silver soared to $50 per ounce (about $200 today). The whole town caught the fever, a mix of FOMO and panic. Then, just like that, a government crackdown on margin trading killed the frenzy.

It's the closest we've been to that kind of mania since. Will history repeat itself? Only time will tell. But one thing's for sure: the hardest part isn't getting in, it's knowing when to get out before the bubble bursts.